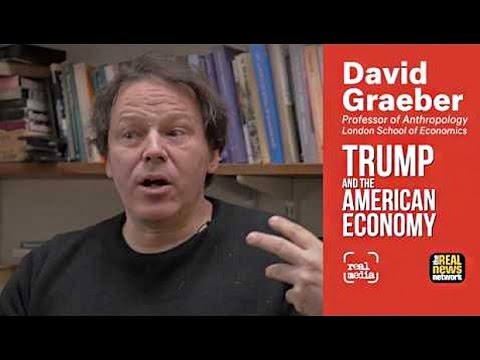

Interviewed by Ranjan Balakumaran

Join thousands of others who rely on our journalism to navigate complex issues, uncover hidden truths, and challenge the status quo with our free newsletter, delivered straight to your inbox twice a week:

Join thousands of others who support our nonprofit journalism and help us deliver the news and analysis you won’t get anywhere else:

Story Transcript

RANJAN BALAKUMARAN: Is Donald Trump an anarchist?

DAVID GRAEBER: No. Donald Trump is a classic corporatist. It’s actually really interesting. When I say corporatist, I mean in the old-fashioned, mid-20th century sense that corporatists are people who say that employers and employees have common interests with each other against finance. This is the soul of most social democracy. Keynes talked about the euthanasia of the rentier class as this feudal leftover. Galbraith talked out the techno-structure, that in corporations there’s a natural common interest around the thing that the corporation does, so they all tend to see outsiders as interlopers interfering. Social democracy had a certain degree of corporatism, but of course under fascism, where you say, “The financiers are all Jews,” and try to kill them.

It tends to be a form of political mobilization that lends itself to a certain form of nativism, at least, and racism, nationalism at worst. Trump clearly made an appeal to that. He’s a classic corporatist in that sense. I think it’s fascinating that he arrives at the moment he did, because for me, what Trump represents is the divorce between finance and real estate. Historically, real estate has been that sector of the capitalist class that has been, little-known fact, most willing to fund left-wing candidates. In the 70s and 80s, they did. People like Harkin got all their money from real estate interests.

The reason for that is fairly obvious. They can’t export their product. They have something they’re selling that they want everybody to be able to buy, so they have an interest in people being able to afford a house. What you have, under financialization, with sub-prime mortgages, is a kind of deal between finance and real estate. You don’t need to deal fund general prosperity. You can just lend them the money. Of course, that all blows up in 2008. You could say Donald Trump’s campaign represents the divorce. He’s a construction and real estate guy, and he runs against finance on a classic corporatist ticket.

Hillary Clinton is here. She represents finance, and she also represents empire. She’s the one who wants to claim she wants to start the wars, because in America, financial structure and the military who oversees empire is basically the same. American political finance is the tribute-taking agency for the American empire. That’s how it works. Hillary represented that.

You have this paradoxical situation where the fascist guy is running as the peace candidate, because that’s what the corporatists do. He teams up with Peter Thiel, who is the I want to move from Silicon Valley to actually making futuristic technologies and go to outer space and whatnot. Trump is futuristic technologies, real estate, construction. That’s why he wanted to build a wall, because construction is the solution to all problems. It’s also a Keynesian employment thing which you can actually get past Republicans.

RANJAN BALAKUMARAN: He’s a corporatist, and interesting that-

DAVID GRAEBER: Old-fashioned mid-century Keynesian nativist, yeah.

RANJAN BALAKUMARAN: Okay. They used to fund the left-wing candidates, so almost explains the reason why he was friends with Hillary for so long, and then afterwards he said, “I’m against finance now.”

DAVID GRAEBER: Yeah.

RANJAN BALAKUMARAN: Marine Le Pen, would you say that this is a very similar thing, or completely different?

DAVID GRAEBER: She’s an old-fashioned fascists are always corporatists. One of the reasons why fascists are doing so well in Europe is for that reason. They’re the only people who can still put out 1940s, 1950s-style economics, which is all about welfare state, full employment, so forth and so on.

RANJAN BALAKUMARAN: Something that I noticed when I watched Nigel Farage and Marine Le Pen was the difference in their views on deregulation. Trump openly loves deregulation, so does Farage, and Marine Le Pen says that she’s completely against it.

DAVID GRAEBER: Which is fascinating. The phrase deregulation is such an ideological … It’s nonsense. I looked into this. Essentially, it’s all about getting in the first claim. We say in law, “It’s who sues who first or claims damages first is 98% of everything.” It’s the same thing. Who gets to claim their legislative change is a deregulation rather than a regulation sets the entire argument.

In America, you have the deregulation of the banks and the deregulation of the telecommunications industry. In the telecommunications case, it was getting rid of a managed competition between a few oligopolies and opening up to a lot of mid-range firms competing with one another. In banks, it’s exactly the other way around. They start with a bunch of mid-range firms competing with each other, or the airlines I’m sorry, but banks too, and they end up with a few oligopolies. Either one is called deregulation. They’re exactly the opposite thing. All that deregulation means is changing the regulatory structure in a way I like.

RANJAN BALAKUMARAN: Right. Deregulation can be consolidation, and deregulation can be competition.

DAVID GRAEBER: Exactly. It’s not about getting rid of government interference, because let’s face it, banks can’t actually be deregulated. Banks are institutions that governments give the right to make up money. You can’t say, “You can make up money any way you like.” That would be absurd. Then they’d just print money and keep it. Banks are intrinsically regulated. Their very existence has to be regulated. They are themselves a form of regulation.

RANJAN BALAKUMARAN: What’s going to happen in the U.S. with the fact that Trump went to this left-wing thing for unions and stuff like that?

DAVID GRAEBER: Classic.

RANJAN BALAKUMARAN: Where do you see all that going?

DAVID GRAEBER: It’s interesting. It’s clear that he was serious, at least at first, about trying to do what he said he was going to do. You could tell, because he got all these crazy people to be his deputies and his major officials. He chose the kind of people you would choose if you wanted people that didn’t have loyalty to the institution but would exactly be loyal to you personally because you’re trying to shake things up.

It’s clear that there’s been a battle, and he’s given ground on most of that stuff, which is too bad, because even though he’s an evil racist bastard, but it’s also true that if anybody is going to be able to dismantle the American empire, it would have to be a right-wing populist. Left-wingers wouldn’t be allowed to get away with it.

RANJAN BALAKUMARAN: I noticed that Gillian Tett did an article. She said that they’re all distressed debt people. She didn’t say all, but she said that the Trump crew in government, they’re distressed debt and ex-distressed debt. I call them buyout people or private equity people.

DAVID GRAEBER: Yeah, that’s interesting.

RANJAN BALAKUMARAN: Because I know that Nigel Farage-

DAVID GRAEBER: We’ve got a lot of Goldman Sachs people. There’s just a big question. Is he just trying to buy them off, or was he just lying about the whole thing? It is true that with a Republican Congress, how can you get a Keynesian make work program through? There’s only two ways. You could do military spending, and he says he’s going to double the size of the Army, despite the fact that he doesn’t want to fight as many people. That’s a good sign that’s it’s all actually a work program.

Also that construction thing. You can play on racism, which is what he did, and say, “We’re going to build a wall,” which everybody realizes is a completely ridiculous, symbolic thing. It’s a make work construction project you could get past a Republican Congress. Fixing the roads and bridges that you need to do, you can’t get through to those guys.

RANJAN BALAKUMARAN: In terms of the debt that he’s going to get into, you’ve written a book about debt. That debt, how is he going to do it and what’s he going to say?

DAVID GRAEBER: His America is in the best possible condition. America can try to destroy the value of the dollar. It probably wouldn’t be able to do it. There’s some signs that they did try at certain points. America has an enormous advantage, which is the more unstable the world is, the more dollars people buy, and it props up the currency. If he figured out various ways to suddenly default, there’s a million ways to do it. Most of the U.S. debt is owed to itself. It’s owned to institutions within the system. They could cancel a lot of that out really easily. A lot of it’s internal bookkeeping money that they’re just using on paper for political advantage.

Trump actually said this. This is one of the interesting things. During the campaign, he broke a lot of taboos. Some of them were saying things that are just obvious lies, but some of them were saying things that were actually true that you’re not supposed to say. One of them was that the U.S. can’t really default on its debt.

RANJAN BALAKUMARAN: As in, it’s impossible for it to do it.

DAVID GRAEBER: Yeah, because they could just make up a way of printing money and giving it to itself. The money would still be good, because the more instability they create, the more the dollar is worth.

RANJAN BALAKUMARAN: Sure. This might sound incredibly technical, and I’m not asking you to explain it, but they said that the Federal Reserve is sitting on four and a half trillion worth of bonds, probably U.S. bonds.

DAVID GRAEBER: I think that’s right.

DAVID GRAEBER: That’s what I mean by it’s owed to itself.

RANJAN BALAKUMARAN: Yeah, sure, so they’ve been getting high off their own supply.

DAVID GRAEBER: Yeah.

RANJAN BALAKUMARAN: They’re now saying they might want to start offloading some of that. What does that mean, and can it be believed?

DAVID GRAEBER: I don’t know. It’s clear that if he wants to do an export-driven industrialization drive, he’s got to lower the value of the dollar. He’s said that. “I’m for a strong dollar because everybody has to say they’re for a strong dollar, but not really,” because a strong dollar is in the interests of finance. It’s essentially a tribute-taking mechanism, again. If the dollar is senior, which is the term they like to use, that a lot of the economic advantage of the U.S., the reason why they can keep more things flowing into the country than are flowing out, is owing to seniorage, which is the fancy, you’re not supposed to know what it means for being the guy who gets to say what money is.

America can just set it up to their advantage any way they like, and have traditionally done so. Michael Hudson has written about this at length. Ever since 73, the American government basically uses Treasury bonds to determine how the international finance system works to their advantage. People let them get away with it because so far there’s no alternative system that won’t be more to somebody else’s disadvantage that would object.

RANJAN BALAKUMARAN: Than the dollar system.

DAVID GRAEBER: Yeah, than the dollar system. It creates a problem for people like Trump because if he wants to revive America industry, you’ve got to export some of that to somebody, unless you’re going to do pure import substitution. Then you need a weak dollar, but he can’t lower the dollar.

RANJAN BALAKUMARAN: I understand that he said, “We need to weaken the dollar,” and then Mnuchin, his Treasury guy, ex-Goldman and all that, he said-

DAVID GRAEBER: He said the opposite, of course.

RANJAN BALAKUMARAN: He said the opposite, yeah. One of the other things that’s going on is this 15% corporation tax. He’s saying that he wants to cut it from 35 down to 15.

DAVID GRAEBER: Which is the stupidest thing you could-

RANJAN BALAKUMARAN: That’s the race to the bottom, isn’t it?

DAVID GRAEBER: … possibly do if you want to increase actual investment by corporations. At this point, they know this. I don’t know if he’s just deluded or if he really does not want to re-industrialize. The point at which the U.S. did the most technological research and had the most productive corporations was when the tax rates were highest. The reason you had Bell Labs in the 50s was they had a 90% tax rate on the highest brackets of income, and they had a 60%, I can’t remember what it was, corporate tax rate. It was very high.

At a certain rate of profits, you’re not going to keep it anyway, so people would say, “Okay, we’ll give higher wages to our workers, make them happy. Why not give it to them instead of the government?” They’d say, “We’ll invest in research, because you can write that off.” There was a massive amount of internal research, and also just general improvement of productivity, because it paid to invest in that if you ended up having to give it in taxes anyway. The more that taxes go down, the more they just take that money and put it in financial stuff instead, basically trapping other people in debt, extracting rents of one kind or another. Lowering the tax rate is just going to cause them to invest even less in productivity and more in predatory activities.

——————————