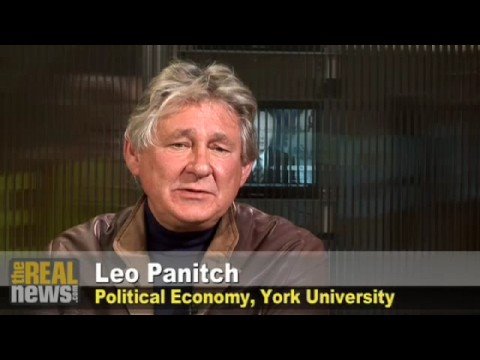

In part two of our series of interviews with Leo Panitch, he gives his explanation of the causes of the financial crisis. According to Leo, the powering of the domestic economy on credit withdrawals instead of wage increases in recent US history is in large part to blame for the current crisis, a situation that Leo blames in large part on the devolution of the American trade union. Finally, Leo explains how the credit freezes affect the real economy.

Story Transcript

PAUL JAY, SENIOR EDITOR: Welcome back to the next segment of our interview with Dr. Leo Panitch, professor of political science at York University in Toronto and the author of American Empire and the Political Economy of International Finance. Thanks for joining us again, Leo.

LEO PANITCH, POLITICAL ECONOMY, YORK UNIV.: Glad to be here, Paul.

Join thousands of others who rely on our journalism to navigate complex issues, uncover hidden truths, and challenge the status quo with our free newsletter, delivered straight to your inbox twice a week:

Join thousands of others who support our nonprofit journalism and help us deliver the news and analysis you won’t get anywhere else:

JAY: So there’s so many pieces to this financial crisis that one can break down and talk about, but one’s struck first of all with the issue of panic. So much of what’s been doing is in terms of the bill, the rescue bill, bailout bill, however you want to label it, is about stopping panic. And the bottom line is people lining up in long lines outside the doors of banks asking to get their money out, ’cause nobody trusts the whole financial system anymore. So there’s that, and then there’s what people are calling “the real economy.” And let’s move to this issue of the real economy to start with, because if people had faith in the real economy, we probably wouldn’t be seeing such chaos in the financial side of it. So talk about the fundamentals, which John McCain says are just fine.

PANITCH: Well, I think it is true to say that had the American corporate sector and American exports not done as well as they’ve done through the last decade, this would be a far, far worse problem than it already is. It’s acted as a stabilizer.

JAY: And that’s to do with the weakness of domestic demand.

PANITCH: It has compensated for the weakness of demand, this demand, but, you know, American exports, partly related to the decline of the dollar, but American corporations have been able to take advantage of it, have been growing by close to double-digit figures for five, six years, which is quite remarkable. And corporations have been quite flush in cash. Their profits have been relatively high. (I’m talking about non-financial corporations.) And that has helped stabilize things. This is talking about outside the auto sector, of course, which is an entirely different thing, and that’s been weak. And so it means particular regions have been really hit, and here in Ontario we’ve suffered from that. So that’s been a stabilizer. At the same time, however, this system has been kept going by consumer credit for 30 years; it’s been kept going by workers expecting that when they get older the value of their homes and the value of the shares that their pension funds hold are going to be worth a fortune, are going to be continually going up.

JAY: The entire society’s sitting around, waiting to cash out, in theory. Most people don’t get a chance, but this cash-out mentality—. I heard this term the other day, which I thought was great: a liquidity event. Everyone’s waiting for the liquidity event.

PANITCH: For the liquidity event. That’s lovely. Exactly. And everybody had confidence in this growth of this asset bubble that has been going on since the early ’80s, with constant crises in it, you know, with constant moments of crises. Then the American state would come in and it would throw an enormous liquidity at the crisis, a helicopter would drop it in, and then the thing would take off again. Well, what happened this time was that it really began to unravel in a serious way, and in such a way that because it hit in the mortgage market and in, above all—it’s not surprisingly—that portion of the mortgage market that was trying to integrate African-American communities, and Chicano communities, etcetera—.

JAY: Well, this is one of the points you make in your recent article is that they needed and got sections of not just the middle section of the working class but even a poorer section of the working class to buy into the cash-out mentality: get into a house with cheap money, sell it for a fortune later on, and everyone will live happily ever after.

PANITCH: Well, in order to be fair, in order to sustain your income, re-mortgage your house, which a fair number of people did. And a lot of these subprime mortgages were not only got into—and although it was that, it was also re-mortgage your house. Part of that was, if I re-mortgage my house, I can maybe add a room and then sell it for a hell of a lot more money, and part of it was that people consume through that. So, you know, at root this has to do with the fact that American trade unionism was defeated 30 years ago, that the Great Society programs which were [inaudible] the 1960s—.

JAY: Back up a step. And in terms of trade unions being defeated, you’re talking about how small the section of the organized workers have gotten. It’s a question of militancy.

PANITCH: That’s one side,—

JAY: And a stasis in wages.

PANITCH: —that there was a constantly declining portion of the American working class that was unionized. But it was not only that. It was that the ability to win wage demands was undermined in a really serious way. And so even those that were unionized from the early ’80s on were suffering a stagnation in their wages.

JAY: And a lot to do with this threat of cheap global labor. If you ask for more money, we’re going to move our factory.

PANITCH: That did, but it also had to do with the kind of reactionary role that labor boards played, and it had to do with the complete defensiveness and confusion of the American trade union leadership, which, you know, had forgotten that they were dealing with a society based on exploitation and didn’t know how to engage in struggle any further. I mean, it really is quite remarkable.

JAY: And just to remind viewers, and you tell me if I’m correct, but essentially ordinary American workers’ wages—and I don’t think Canadians are that much better off—more or less in 1972, wage labor—.

PANITCH: Some people say. It varies by sector. But their standard of living has not gone down. And why has it not gone down? Because of credit, or because whole families are working, or because people are working much longer hours. So that’s really what’s happened. And, yes, we’ve come up against the kind of crisis that depends on people being able to borrow in order to spend. The borrowing goes through the credit system, goes through the banking system, whether it’s through mortgages, through credit card debt, what have you, and this spills over to the real economy in the sense of, you know, will this seize up, this credit-driven demand? But not only that—.

JAY: But seize up because so much of the credit is to—

PANITCH: Is to working people.

JAY: —who can’t really afford it.

PANITCH: Yeah. But that isn’t all. It also, of course, while the non-financial sector has done relatively well, they’ve got to be able to issue what is called commercial paper, even the big corporations, you know, through which, in the short term, getting into the money market, they pay their workers, they buy supplies, etcetera. And the danger is: will that seize up? *And that began [inaudible]

JAY: *Or default, or major corporate default on that too.

PANITCH: To some extent that’s been a problem. And so, in the short-term money market, you know, non-financial corporations are involved in it. And then you see the problem of small-, medium-sized corporations having trouble getting access to debt, as the banking system, you know, they’re afraid to lend. They don’t know what calls are going to be on their money. They’re afraid to lend money out. And this is the kind of thing that leads to a recession and can lead—although it certainly hasn’t happened since the 1930s—to, you know, the equivalent of the Great Depression. That also brings in government debt, not so much at the federal level, especially in the case of the United States, where people see the American state as the guarantor; it’ll never default on its debt, etcetera. And that was kind of proven by the way they immediately nationalized—re-nationalized Fannie Mae and Freddie Mac, ’cause everybody took that as government corporations, even though, you know, there had been this privatization under Johnson in the 1960s. But the municipalities in the States are having difficulty selling their bonds.

JAY: Well, in the next segment of our interview, let’s talk about what is the next consequences of where we’re at right now, for cities, for states, and Canada, for provinces and cities, and the whole issue of what’s going to happen to these jurisdictions that base their taxes on property, if property keeps tanking.

PANITCH: Yeah, let’s do that.

JAY: Thanks for joining us. Please join us for the next segment of our interview with Leo Panitch on the current financial crisis.

DISCLAIMER:

Please note that TRNN transcripts are typed from a recording of the program; The Real News Network cannot guarantee their complete accuracy.